Mergers Acquisitions M&A Process

This guide outlines all the steps in the M&A process

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

Overview of the M&A Process

The mergers and acquisitions (M&A) process has many steps and can often take anywhere from 6 months to several years to complete. In this guide, we’ll outline the acquisition process from start to finish, describe the various types of acquisitions (strategic vs. financial buys), discuss the importance of synergies (hard and soft synergies), and identify transaction costs. To learn all about the M&A process, watch our free video course on mergers and acquisitions.

10-Step M&A Process

If you work in either investment banking or corporate development, you’ll need to develop an M&A deal process to follow. Investment bankers advise their clients (the CEO, CFO, and corporate development professionals) on the various M&A steps in this process.

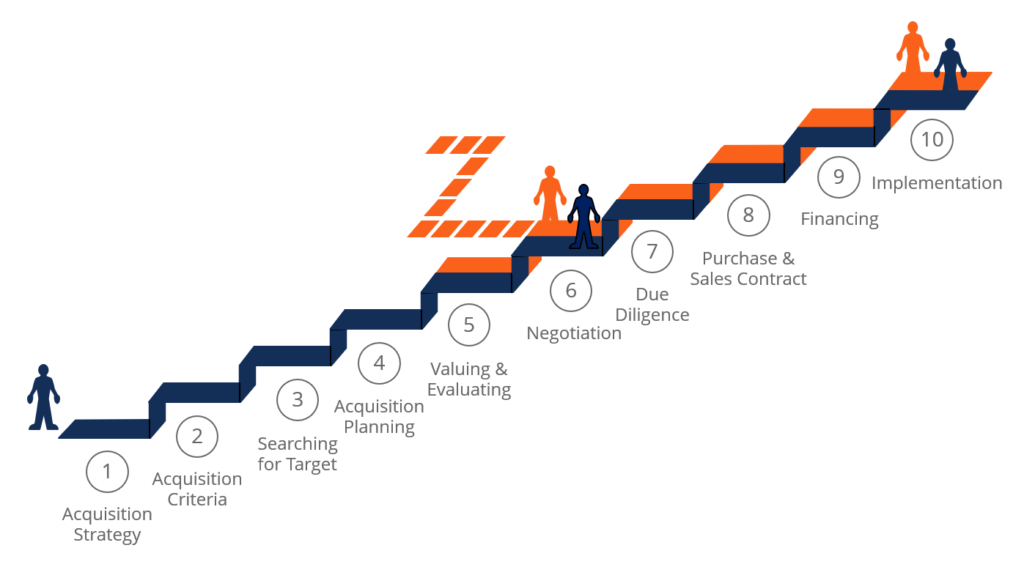

A typical 10-step M&A deal process includes:

- Develop an acquisition strategy – Developing a good acquisition strategy revolves around the acquirer having a clear idea of what they expect to gain from making the acquisition – what their business purpose is for acquiring the target company (e.g., expand product lines or gain access to new markets)

- Set the M&A search criteria – Determining the key criteria for identifying potential target companies (e.g., profit margins, geographic location, or customer base)

- Search for potential acquisition targets – The acquirer uses their identified search criteria to look for and then evaluate potential target companies

- Begin acquisition planning – The acquirer makes contact with one or more companies that meet its search criteria and appear to offer good value; the purpose of initial conversations is to get more information and to see how amenable to a merger or acquisition the target company is

- Perform valuation analysis – Assuming initial contact and conversations go well, the acquirer asks the target company to provide substantial information (current financials, etc.) that will enable the acquirer to further evaluate the target, both as a business on its own and as a suitable acquisition target

- Negotiations – After producing several valuation models of the target company, the acquirer should have sufficient information to enable it to construct a reasonable offer; Once the initial offer has been presented, the two companies can negotiate terms in more detail

- M&A due diligence – Due diligence is an exhaustive process that begins when the offer has been accepted; due diligence aims to confirm or correct the acquirer’s assessment of the value of the target company by conducting a detailed examination and analysis of every aspect of the target company’s operations – its financial metrics, assets and liabilities, customers, human resources, etc.

- Purchase and sale contract – Assuming due diligence is completed with no major problems or concerns arising, the next step forward is executing a final contract for sale; the parties make a final decision on the type of purchase agreement, whether it is to be an asset purchase or share purchase

- Financing strategy for the acquisition – The acquirer will, of course, have explored financing options for the deal earlier, but the details of financing typically come together after the purchase and sale agreement has been signed

- Closing and integration of the acquisition – The acquisition deal closes, and management teams of the target and acquirer work together on the process of merging the two firms

Structuring an M&A Deal

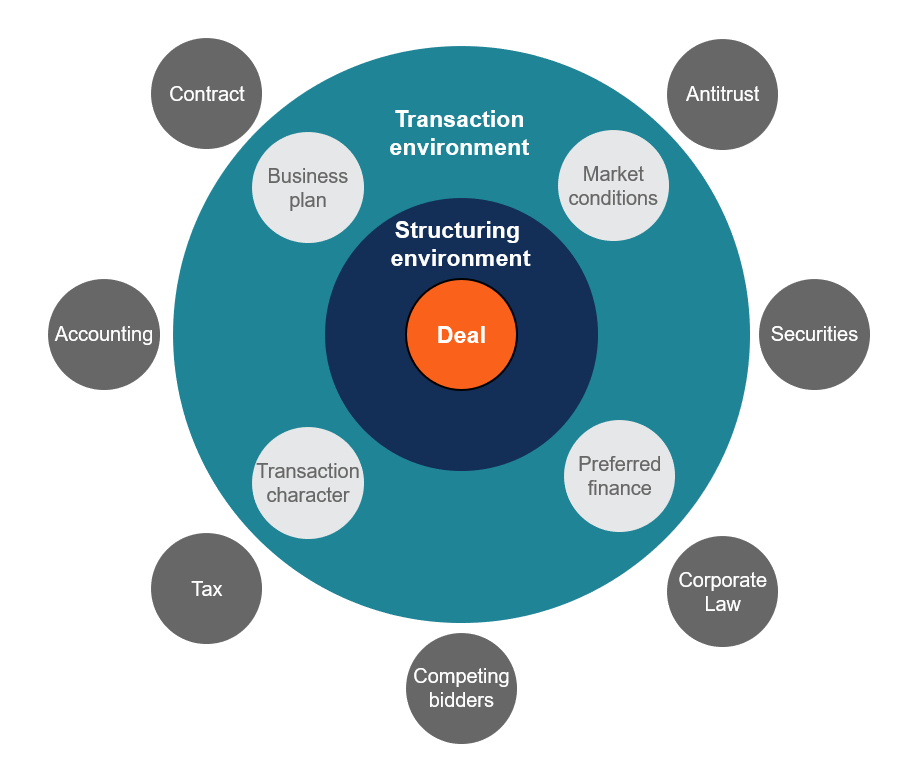

One of the most complicated steps in the M&A process is properly structuring the deal. There are many factors to be considered, such as antitrust laws, securities regulations, corporate law, rival bidders, tax implications, accounting issues, market conditions, forms of financing, and specific negotiation points in the M&A deal itself. Important documents when structuring deals are the Term Sheet (used for raising money) and a Letter of Intent (LOI) which lays out the basic terms of the proposed deal.

To learn more, watch CFI’s free Corporate Finance 101 course.

Rival bidders in M&A

The vast majority of acquisitions are competitive or potentially competitive. Companies normally have to pay a “premium” to acquire the target company, and this means having to offer more than rival bidders. To justify paying more than rival bidders, the acquiring company needs to be able to do more with the acquisition than the other bidders in the M&A process can (i.e., generate more synergies or have a greater strategic rationale for the transaction).

Strategic vs Financial Buyers in M&A

In M&A deals, there are typically two types of acquirers: strategic and financial. Strategic acquirers are other companies, often direct competitors or companies operating in adjacent industries, such that the target company would fit in nicely with the acquirer’s core business. Financial buyers are institutional buyers, such as private equity firms, that are looking to own, but not directly operate the acquisition target. Financial buyers will often use leverage to finance the acquisition, performing a leveraged buyout (LBO).

We discuss this in more detail in the M&A section of our Corporate Finance course.

Analyzing Mergers and Acquisitions

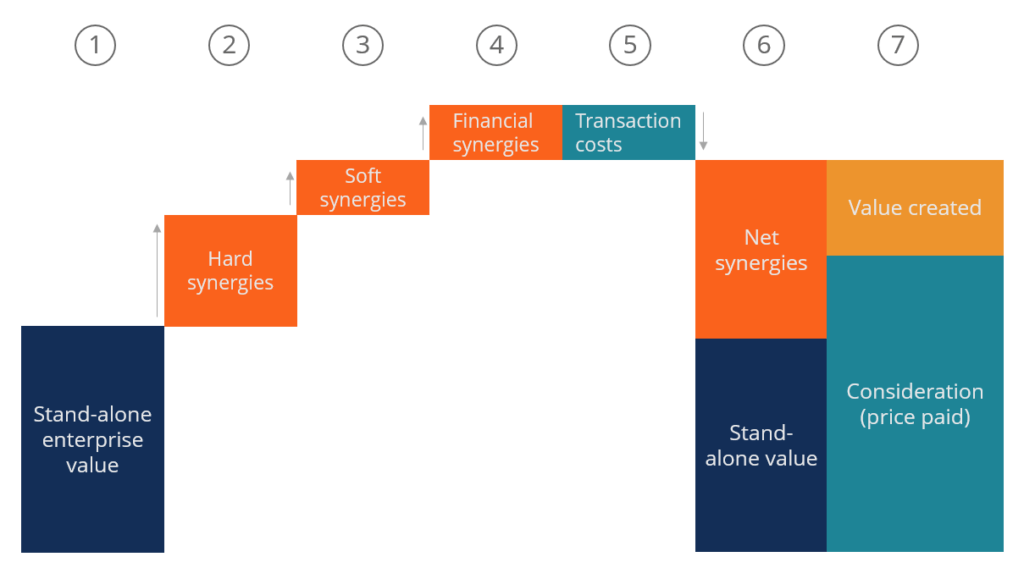

One of the biggest steps in the M&A process is analyzing and valuing acquisition targets. This usually involves two steps: valuing the target on a standalone basis and valuing the potential synergies of the deal. To learn more about valuing the M&A target see our free guide on DCF models.

When it comes to valuing synergies, there are two types of synergies to consider: hard and soft. Hard synergies are direct cost savings to be realized after completing the merger and acquisition process. Hard synergies, also called operating or operational synergies, are benefits that are virtually sure to arise from the merger or acquisition – such as payroll savings that will come from eliminating redundant personnel between the acquirer and target companies.

Soft synergies, also called financial synergies, are revenue increases that the acquirer hopes to realize after the deal closes. They are “soft” because realizing these benefits is not as assured as the “hard” synergy cost savings. Learn more about the different types of synergies.

To learn more, check out CFI’s Introduction to Corporate Finance course.

Careers Involved in the M&A Process

The most common career paths to participate in M&A deals are investment banking and corporate development. Investment bankers advise their clients on either side of the acquisition, either the acquirer (buy-side) or the target (sell-side). The bankers work closely with the corporate development professionals at either company. The Corp Dev team at a company is like an in-house investment banking department and sometimes is referred to internally as the M&A team. They are responsible for managing the M&A process from start to finish.

To learn more, explore our Interactive Career Map.

Watch a Video of the M&A Process

This short video explains each of the 10 steps outlined above. Watch and listen to an overview of how the process works.

More M&A Transaction Resources

We hope this has been a helpful overview of the various steps in the M&A process. CFI has created many more useful resources to help you more thoroughly understand mergers and acquisitions. Among our most popular resources are the following articles:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in