Cost Structure

The different types of cost structures incurred by a business

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

What is Cost Structure?

Cost structure refers to the various types of expenses a business incurs and is typically composed of fixed and variable costs. Costs may also be divided into direct and indirect costs. Fixed costs are costs that remain unchanged regardless of the amount of output a company produces, while variable costs change with production volume.

Direct costs are costs that can be attributed to a specific product or service, and they do not need to be allocated to the specific cost object. Indirect costs are costs that cannot be easily associated with a specific product or activity because they are involved in multiple activities.

Operating a business must incur some kind of costs, whether it is a retail business or a service provider. Cost structures differ between retailers and service providers, thus the expense accounts appearing on a financial statement depend on the cost objects, such as a product, service, project, customer or business activity. Even within a company, cost structure may vary between product lines, divisions or business units, due to the distinct types of activities they perform.

Key Highlights

- Cost structure refers to the various types of expenses a business incurs and is typically composed of fixed and variable costs, or direct and indirect costs.

- Fixed costs are incurred regularly and are unlikely to fluctuate over time. Variable costs are expenses that vary with production output.

- Direct costs are costs that are directly related to the creation of a product and can be directly associated with that product. Direct costs are usually variable costs, with the possible exception of labor costs. Indirect costs are costs that are not directly related to a specific cost object. Indirect costs may be fixed or variable.

- Having a firm understanding of the difference between fixed and variable and direct and indirect costs is important because it shapes how a company prices the goods and services it offers.

Fixed vs. Variable Costs

Fixed costs

Fixed costs are incurred regularly and are unlikely to fluctuate over time. Examples of fixed costs are overhead costs such as rent, interest expense, property taxes, and depreciation of fixed assets. One special example of a fixed cost is direct labor cost. While direct labor cost tends to vary according to the number of hours an employee works, it still tends to be relatively stable and, thus, may be counted as a fixed cost, although it is more commonly classified as a variable cost where hourly workers are concerned.

Variable costs

Variable costs are expenses that vary with production output. Examples of variable costs may include direct labor costs, direct material cost, and bonuses and sales commissions. Variable costs tend to be more diverse than fixed costs. For businesses selling products, variable costs might include direct materials, commissions, and piece-rate wages. For service providers, variable expenses are composed of wages, bonuses, and travel costs. For project-based businesses, costs such as wages and other project expenses are dependent on the number of hours invested in each of the projects.

Direct vs. Indirect Costs

Direct costs

As alluded to earlier, direct costs are costs that are directly related to the creation of a product and can be directly associated with that product. Direct material is an example of a direct cost.

Direct costs are almost always variable because they are going to increase when more goods are produced. As discussed earlier, an exception to this is labor. Employee wages may be fixed and unlikely to change over the course of a year. However, if the employees are hourly and not on a fixed salary then the direct labor costs can increase if more products are manufactured.

Indirect costs

Indirect costs are costs that are not directly related to a specific cost object like a function, product or department. They are costs that are needed for the sake of the company’s operations and health. Some other examples of indirect costs include overhead, security costs, administration costs, etc. The costs are first identified, pooled, and then allocated to specific cost objects within the organization.

Indirect costs may be either fixed or variable costs. An example of a fixed cost is the salary of a project supervisor assigned to a specific project. An example of a variable indirect cost would be utilities expense. This expense may fluctuate depending on production (for example, there would be an increase in utility expense if a manufacturing plant is running at a higher capacity utilization).

Having a firm understanding of the difference between fixed and variable and direct and indirect costs is important because it shapes how a company prices the goods and services it offers. Knowing the actual costs of production enables the company to price its products efficiently and competitively.

Cost Allocation

Cost allocation is the process of identifying costs incurred, and then accumulating and assigning them to the right cost objects (e.g. product lines, service lines, projects, departments, business units, customers, etc.) on some measurable basis. Cost allocation is used to distribute costs among different cost objects in order to calculate the profitability of different product lines.

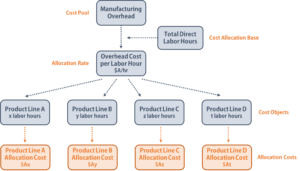

Cost pool

A cost pool is a grouping of individual costs, from which cost allocations are made later. Overhead cost, maintenance cost and other fixed costs are typical examples of cost pools. A company usually uses a single cost-allocation basis, such as labor hours or machine hours, to allocate costs from cost pools to designated cost objects.

Example of cost allocation

A company with a cost pool of manufacturing overhead uses direct labor hours as its cost allocation basis. The company first accumulates its overhead expenses over a period of time (for example, a year) and then divides the total overhead cost by the total number of labor hours to find out the overhead cost “per labor hour” (the overhead allocation rate). Finally, the company multiplies the hourly cost by the number of labor hours spent to manufacture a product to determine the overhead cost for that specific product line.

The Importance of Cost Structures and Cost Allocation

To maximize profits, businesses must find every possible way to minimize costs. While some fixed costs are vital to keeping the business running, a financial analyst should always review the financial statements to identify possible excessive expenses that do not provide any additional value to core business activities.

When an analyst understands the overall cost structure of a company, they can identify feasible cost-reduction methods without affecting the quality of products sold or service provided to customers. The financial analyst should also keep a close eye on the cost trend to ensure stable cash flows and no sudden cost spikes occurring.

Cost allocation is an important process for a business because if costs are misallocated, then the business might make wrong decisions, such as over/underpricing a product, or invest unnecessary resources in non-profitable products. The role of a financial analyst is to make sure costs are correctly attributed to the designated cost objects and that appropriate cost allocation bases are chosen.

Cost allocation allows an analyst to calculate the per-unit costs for different product lines, business units, or departments, and, thus, to find out the per-unit profits. With this information, a financial analyst can provide insights on improving the profitability of certain products, replacing the least profitable products, or implementing various strategies to reduce costs.

Additional Resources

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in