Cap Table

A spreadsheet listing all the ownership stakes in the company

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

What is a Cap Table?

A cap table (also called capitalization table) is a spreadsheet for a startup company or early-stage venture that lists all the company’s securities, such as common shares, preferred shares, warrants, who owns them, and the prices paid by the investors for these securities. It indicates each investor’s percentage of ownership in the company, the value of their securities, and dilution over time.

Cap tables are created first, before other company documents, in the early stages of a startup or venture. After a few rounds of financing, the cap tables become complex and list the potential sources of funding, initial public offerings, mergers and acquisitions, and other transactions.

Apart from recording transactions, a cap table also comprises many legal documents such as stock issuances, transfers, cancellations, conversion of debt to equity, and other documents. The executives must manage all these transactions and documents accurately to show the events since the company’s inception.

The simplest form of cap tables lists the shareholders at the beginning and their respective share ownership. Cab tables are used by venture capitalists, entrepreneurs, and investment analysts to analyze important events such as ownership dilution, employee stock options, and the issue of new securities.

How to Make a Cap Table

Most companies use spreadsheets to create a cap table at the inception of the business. The cap table should be designed in a simple and organized layout that clearly shows who owns certain shares and the number of outstanding shares. The most common structure is to list the names of investors/security owners on the Y-axis, while the type of securities is listed on the X-axis.

Alternatively, a company can use a spreadsheet template that allows for the addition of information and figures related to their business. The first row should indicate the total number of shares of the company. The subsequent rows should list the following:

- Authorized shares: Number of shares the company is allowed to issue.

- Outstanding shares: Number of shares held by all shareholders in the company.

- Unissued Shares: Number of shares that have not been issued.

- Shares reserved for stock option plan: Unissued shares reserved for future hires.

A separate table in the capitalization table should include the following:

- Names of shareholders: The names of shareholders who have bought shares in the company.

- Shares owned by each shareholder: The number of shares held by each shareholder.

- Stock options: Stock options owned by each shareholder.

- Fully diluted shares: Total number of outstanding shares (helps shareholders determine the value of their shares).

- Options remaining: Number of remaining shares available to be optioned.

The company’s founders are listed first in the table, followed by executives and other employees who own equity, and then investors such as angel investors and venture capitalists.

Cap Table Example

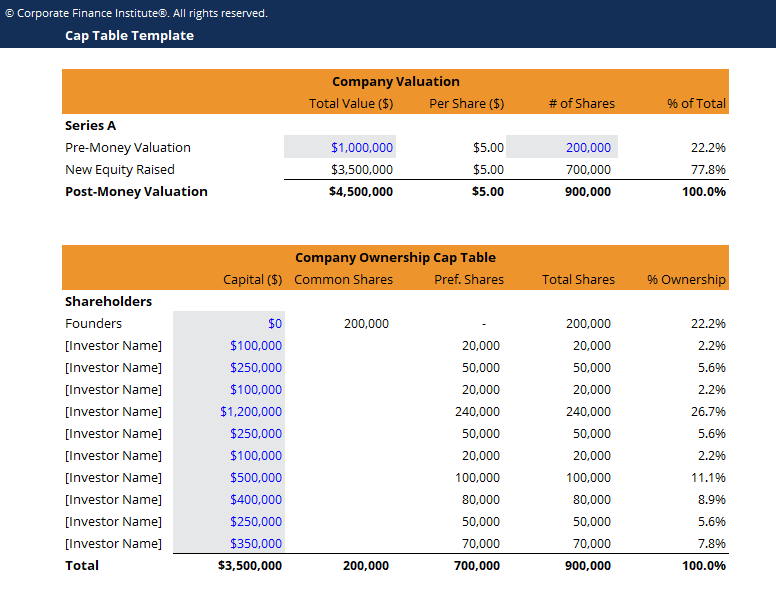

Below is a cap table example from one of CFI’s many free excel templates.

The spreadsheet below contains two sections – valuation and ownership. All numbers in blue are hard-coded assumptions and all numbers in black are formulas.

In the valuation section, enter the current company value (i.e. $1 million) and the current number of shares outstanding (i.e. 200,000).

In the ownership section, enter the dollar value each investor is contributing to the funding round (i.e. $100,000 for investor 1, $250,000 for investor 2, etc.).

Download the Free Template

Enter your name and email in the form below and download the free template now!

Capitalization Table Template

Download the free Excel template now to advance your finance knowledge!

Updating the Cap Table

With each additional round of funding, the cap table requires updating. For example, issuing new shares of an existing security, increasing or decreasing stock options for employees, and issuing new shares of a security requires the cap table to be updated to reflect the changes.

Also, the exit of key shareholders, transfer of shares to another existing shareholder or new shareholder, and termination and retirement of employees require the company to update the cap table.

An updated cap table helps entrepreneurs and venture capitalists make informed decisions based on the current information. Also, US companies use their cap tables as the only system of recording stock ownership. US laws allow cap tables to be used as a formal legal record of equity ownership, and must, therefore, be continually updated to reflect any changes in the stock ownership.

Waterfall Analysis

Waterfall analysis indicates the amount every shareholder on the cap table would receive based on the amount available to equity in a liquidity scenario. Liquidity events are usually uncertain, and the shareholders cannot foresee how and when they will occur. Waterfall analysis relies on a range of assumptions to show the actual percentage of proceeds that would be distributed to shareholders if the company is liquidated.

The cap table typically indicates the accounting ownership of individual shareholders, which is the actual ownership percentage. Accounting ownership varies from economic ownership, which is the percentage of ownership available to equity.

How Cap Tables are Used

#1 Raising funds

When negotiating with investors for new funding, investors are interested in seeing how the company’s ownership is structured and the changes that have occurred in the previous financing rounds. Investors may have questions that can be answered by the cap table.

For example, new investors will want to know the impact of their investments on other investors. They want to avoid any potential litigious situations that may put them at loggerheads with other investors. Investors also want to see where they sit in the liquidity rank. They want to sit at the top so that they can be paid back before other investors in case a liquidity event occurs.

#2 Hiring Employees

Although companies mainly focus on investors and executives, most companies are becoming transparent with their employees about cap tables. This helps in retaining well-performing employees and keeping them motivated to continue serving the company.

Company executives want to know the payouts they will receive from their ownership percentage if the company sells or is liquidated. Companies that are transparent and organized have higher chances of retaining their employees, even when the firm is facing financial distress.

#3 Tax and Regulation Compliance

In most countries, such as the United States, cap tables are used as a formal legal record of equity ownership. The tax authorities rely on cap tables to determine if the company, employees, and investors pay the required amount of taxes.

If the cap tables are not updated continuously, the company or its employees may end up paying more taxes than they need to. If the company submitted fewer taxes than required, they may end up paying high penalties for mistakes that they could have avoided.

#4 Selling the Company

When the company decides to sell the business to another company, the proceeds from the sale are divided among shareholders. The cap table outlines how much each shareholder gets from the proceeds and in what order. An updated cap table helps eliminate any disagreements and lawsuits that may arise from the proceeds distribution.

Additional resources

Thank you for reading CFI’s guide to Cap Table. To continue learning and advancing your career, these additional resources will be helpful:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in