Excel vs. Automation in Financial Modeling

Learn about the software used in financial modeling

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

What Software is Used in Financial Modeling?

Before we discuss Excel vs. automation in financial modeling, let’s take a look first at how software is used to build financial models. Financial modeling involves creating an abstract representation of an actual or projected financial event. Thus, a financial model is a mathematical tool that can be used in software like Microsoft Excel to help in designing the abstract model.

Financial modeling is important to businesses because it can help to predict how a company is likely to perform financially in the future. To predict financial performance, a financial modeler utilizes the company’s historical performance while making assumptions about the future.

There are two ways of doing financial modeling. The traditional way involves using Excel spreadsheets. However, companies are starting to embrace the concept of automating the task of financial modeling.

Key Highlights

- When it comes to building a financial model, there are many trade-offs between using Excel and a different, specific financial modeling software.

- Using Excel is a totally customizable way of building a model from scratch and can handle any type of layout, structure, calculation, or format you want. However, it is prone to errors.

- Financial modeling software offers the structure and error prevention we all want in our analysis but at the cost of not being able to accommodate attributes that are specific to a company or an asset.

Excel vs. Automation – Building and Designing Financial Models

When designing financial models, one needs to make many tradeoffs between using Excel and other software that automates most tasks. Financial analysts and other users of financial information continue to debate on which one is better. Let’s see the differences between the two:

1. Customization

Given that Excel is manned by a human modeler, it offers a great deal of customization. The fact that Excel allows one to design a model from scratch means that individuals enjoy a lot of freedom in structuring the model the way they want. Also, they can format the model based on the needs of the business for which they are modeling.

For example, if there are some asset-specific features that need addressing in the model, those may only be achieved using Excel. In contrast, using specific financial modeling software may limit the scope of customization, as it is already pre-programmed.

2. Structured outcome

The best time to use financial modeling software is if one is dealing with a specific structure for a model. In such a way, the human modeler can reduce the likelihood of making errors as most of the tools they will use are programmed to prevent errors.

On the other hand, the likelihood of making errors when using an Excel model is higher than with an automated system. So, if there’s an emphasis on standardization and accuracy, the better approach is to use financial modeling software.

3. Development of analytical skills

However, if a modeler is more interested in understanding a business, an Excel model is much better. This is because using Excel involves going through the meticulous process of calculating pretty much everything. Although tedious, the act of computing different financial records really helps one to understand the business better.

Now imagine that the modeler was using a software program instead. The program would use the company’s financial statements, capital structure, and forecast, and then reveal a net present value (or a different desired output) spontaneously. Even though it saves time, it would not teach the modeler much about the business itself.

Learn more about different ways of utilizing Excel to model financial statements.

4. Risk analysis

Although specific modeling software doesn’t necessarily enlighten a modeler about a business, it is generally better than Excel with regards to risk management. Even though one can run a sensitivity analysis on Excel, the whole process will be completely manual; hence, increasing the probability of making errors or observing incorrect results. Risk analysis methods like sensitivity analysis and Monte Carlo simulation are more easily performed with financial modeling software, which offers higher precision.

5. Logical interpretation

To be able to forecast accurately, a financial modeler needs to apply a specific logic to determine an outcome, and this may only be possible in Excel. With an Excel spreadsheet, the analyst can examine a company’s data, make certain assumptions, study the relationship between financial statements, and ultimately compute the formula.

There’s a need to assess the relationship between the dependent variables in order to apply logic, and that can be very hard to achieve when using software. Since certain financial modeling software uses built-in tools of logic, it’s not always possible to analyze the flow of individual operations.

6. Visual representation

Visual representation makes up an important part of financial modeling. While Excel is very good at representing data in graphical form, there may be other, third-party resources that are even better.

7. Handling complex data

Although Excel has proven to be an effective method thus far, there are a few areas where it falls short, particularly in handling complex sets of data. However, with financial modeling software, one can compute multidimensional and large sets of data without any difficulty. Most programs allow modelers to create and switch the rows and columns layout of the model based on the situation at hand.

Should companies automate financial modeling?

Whether financial modeling should be automated or not will depend on individual company needs. As an example, small businesses that deal with small data sets and don’t need very structured outcomes should use Excel because it gives the owner insight into their operations.

However, if a company is dealing with diverse and large data sets or is more interested in precision and risk management, then automating its financial modeling is the best option.

Additional Resources

CFI offers the Financial Modeling & Valuation Analyst (FMVA)™ certification program for those looking to take their careers to the next level. To keep learning and advancing your career, the following CFI resources will be helpful:

Analyst Certification FMVA® Program

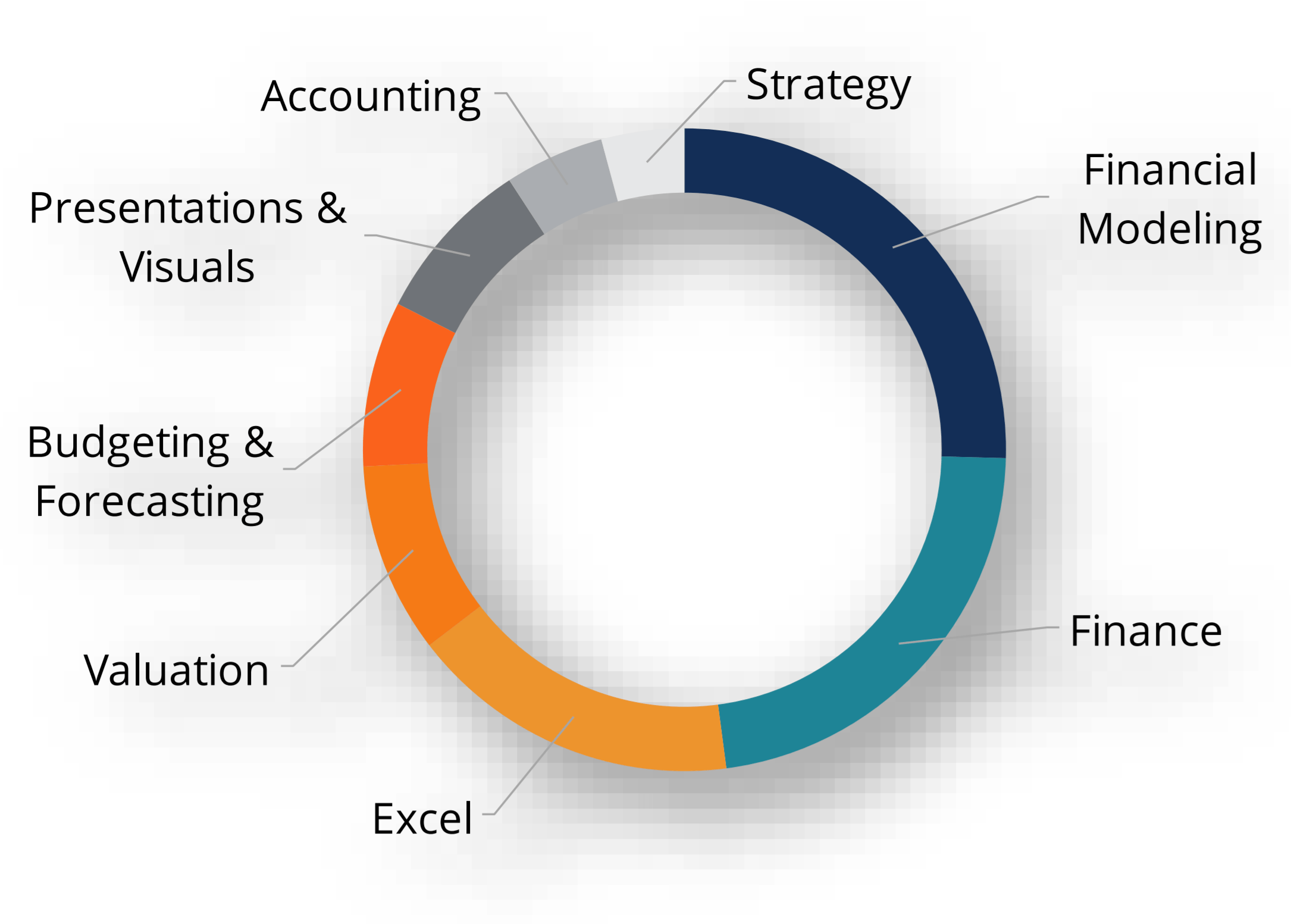

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?

Become a Certified Financial Modeling & Valuation Analyst (FMVA)®

Master financial modeling and improve your proficiency across the entire accounting and finance universe

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in