The Failure of First Republic Bank

San Francisco-based regional bank that collapsed in 2023 and was sold to JPMorgan Chase

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

Another US Regional Bank Failure?

First Republic Bank was seized by the Federal Deposit Insurance Corp. (FDIC) and sold to JPMorgan Chase in a fire sale on May 1, 2023.

This marked the end of the San Francisco-based lender that specialized in banking wealthy individuals and marked the third US regional bank to collapse in 2023[1].

When it failed, the lender had assets of $229bn, which made First Republic the second-largest bank failure in the US, displacing Silicon Valley Bank, which failed in March 2023.

| Bank | Assets | Year |

|---|---|---|

| Washington Mutual | $307bn | 2008 |

| First Republic | $229bn | 2023 |

| Silicon Valley Bank | $200bn | 2023 |

| Signature Bank | $110bn | 2023 |

| IndyMac | $32bn | 2008 |

| Colonial Bank | $25bn | 2009 |

Key Highlights

- First Republic Bank was a San Francisco-based lender that was among the top 20 banks in the US before it collapsed in May 2023.

- The Bank was a specialized lender that focused on the wealthy and high-net-worth client base and their real estate mortgages.

- The FDIC seized the bank and JPMorgan Chase acquired it to prevent any losses to depositors in the second largest ever bank failure in the United States.

Background and History of First Republic Bank

First Republic Bank was founded in 1985 in San Francisco, California. The bank grew quickly, taking it from one of the smallest banks in 1985 to one of the largest US banks. By 2020, First Republic Bank (FRB) was among the top 20 banks by asset size, growing at a rate of 25% per year over 35 years[2].

In 2007, FRB was acquired by US investment broker, Merrill Lynch, which was subsequently bought by Bank of America during the Global Financial Crisis. In 2010, FRB was once again sold, this time to a group of private investors who took the company public later that year.

In 2023, the bank had 84 offices across eight states in America and had more than 7,200 employees.

Jumbo loans

In addition to the standard bank offering of personal and business banking, FRB’s business model was very specialized, targeting wealthy individuals in California and New York with low interest mortgages on expensive residential properties. Some of these loans also had “interest-only” provisions, where homeowners weren’t required to make principal payments for a decade.

These terms left FRB’s wealthy customers were left with more cash to spend and invest than if they financed their mortgages with conventional mortgages.

These homeowners tend to be good credit risk, with strong incomes and debt service histories, so the business model was very successful in a low rate environment, attracting more and more customers. As a matter of fact, loans at FRB rose from $58bn to over $135bn in just 5 years.

Deposits

These wealthy individuals and the companies they controlled also looked to park their savings at FRB. Deposits almost tripled from $58.6bn to $156.3bn in the period of 2016 to 2021[2].

Additionally, given the wealthy customer base, a large proportion of the deposits, estimated to exceed 2/3s[3], held at FRB exceeded the $250,000 deposit protection limit offered by the FDIC, hence uninsured.

Bank Run and FDIC Intervention

Rate hikes

The business of catering to wealthy individuals, lending money against their properties and banking the companies they own works very well in a low-rate environment. However, as the US Federal Reserve embarked on its rate hiking cycle in 2022, it has led to major problems for banks like FRB (and Silicon Valley Bank).

Firstly, the higher rate environment caused banks to have to mark down the value of their low-rate mortgages on their books, at least on paper. Secondly, and more importantly, higher rates mean that banks like First Republic must also pay much more interest on their huge amount of deposits.

US regional bank failure contagion

The failures of Silicon Valley Bank and Signature Bank in March 2023 certainly did not help the confidence of depositors in US regional banks. Additionally, we had the high-profile collapse of Swiss banking giant Credit Suisse and its subsequent arranged rescue by rival, UBS.

As a matter of fact, the potential contagion risk to the US banking sector caused US Treasury Secretary, Janet Yellen, to help engineer a financial lifeline for FRB as far back as March 16, 2023. This lifeline consisted of 11 major US banks, including the “Big Four” — JPMorgan Chase, Citibank, Bank of America and Wells Fargo — placing deposits totaling $30bn at FRB for a minimum term of 120 days as a major show of support.

| Deposits to First Republic | Contribution per Bank |

|---|---|

| JPMorgan Chase, Bank of America, Citibank, Wells Fargo | $5bn |

| Goldman Sachs, Morgan Stanley | $2.5bn |

| PNC, BNY Mellon, US Bancorp, State Street, Truist | $1bn |

Bank run

However, the optimism was short-lived. On FRB’s April 24th investor call, quarterly financial statements revealed that the lender had lost $72bn in deposits in the first quarter[4]. Even today, when deposits can be moved electronically almost any time of day, the speed at which FRB’s depositors fled the bank was astonishing.

The beleaguered management team chose not to answer questions, prompting many analysts to walk away unimpressed and more importantly, downgrade their recommendations on the bank’s stock, which eventually lost over 97% of its market value before the collapse[5].

On April 26, Bloomberg[6] reported that First Republic was looking at various rescue plans, such as potentially sell assets to other banks with warrants or preferred equity as sweetners to buy the holdings above their market value.

On April 30, the FDIC stepped in to seize the bank and at the same time, asked for proposals from acquirers with a goal to announce a rescue plan before FRB opened for business on Monday, May 1. The goal of the rescue plan was to ensure that the deposit holders weren’t impacted and that the potential losses to the FDIC be minimized.

Acquisition by JPMorgan Chase

On Sunday, May 7, JPMorgan Chase emerged as the winner in the FDIC’s bidding process. Their closest competitor, PNC Financial, reportedly didn’t offer as clean and comprehensive a package as JPMorgan Chase did, who effectively took the whole FRB off the hands of the FDIC. This was more attractive to the FDIC than proposals which would have required FRB to be broken up or messy guarantees of the mortgages held at FRB.

Too big to fail

In some ways, JPMorgan Chase was the ideal suitor. Being one of the “Big Four” banks that the US government consider “too big to fail,” it would ensure that any possible contagion from depositors might be contained. Jamie Dimon, the CEO of JPMorgan Chase, was one of the architects of the “life line” that Treasury Secretary Yellen offered to FRB and were on the hook for $5bn in any event.

Terms of the deal

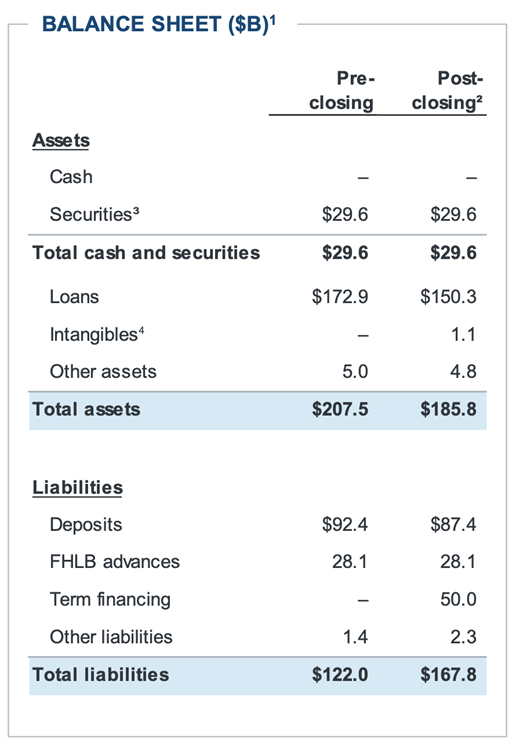

The terms of the acquisition were that JPMorgan Chase would acquire all of FRB’s liabilities. This amounted to roughly $122bn[7], of which $62.4bn was in deposits, so all FRB depositors would immediately become customers of JPMorgan Chase since all 84 branches would open on Monday, May 1 as branches of JPMorgan Chase[8]. The remaining liabilities, including the $30bn “lifeline” from US banks (including JPMorgan Chase) and advance from the Federal Home Loan Bank (FHLB) system of $28bn, would all be taken over by JPMorgan Chase as well.

In return, JPMorgan Chase assumed the $207.5bn in total assets, including $172.9bn in loans and $29.6bn in securities, plus some goodwill of $5bn. JPMorgan Chase will pay $10.6bn to the FDIC and gets a 5-year loan of $50bn from the FDIC after closing, as well as taking a one-time gain of $2.6bn for the rescue.

Additionally, JPMorgan Chase and the FDIC have entered into a loss-sharing agreement on the loan portfolio of FRB (around $100bn or so), where the FDIC will bear 80% of any potential mortgage or commercial loan losses.

Lastly, the FDIC anticipates a cost to the Deposit Insurance Fund (DIF) of approximately $13bn. The DIF itself is funded by quarterly fees that US banks are required to pay to the FDIC as assessments on their total liabilities[9].

Why Do US Regional Banks Keep Failing?

Ultimately, the FDIC and the US government don’t want (and are financially incapable) to end up paying for all the deposits held at US regional banks. However, the difference between SVB, Signature, and now FRB is the involvement of another financial institution, JPMorgan Chase.

Root causes

Unlike SVB, which collapsed due to poor asset/liability sheet management, and Signature Bank, which was overextended in crypto assets, the root cause of FRB’s failure was due to the niche lending in jumbo mortgages and the high percentage of uninsured deposits that would leave the bank quickly in a potential bank run scenario.

There are those who blame the spate of US regional bank failures on the pace of aggressive Federal Reserve policy rate hikes since 2022.

However, there are those who are calling the recent spate of bank failures in the US as a problem of banking supervision as the commonality between all three failures has been lax bank management and supervision. This stems from the Trump-era Crapo Bill which raised the asset threshold for enhanced regulatory oversight from $50bn to $250bn, ostensibly to reduce red tape.

How to Protect Yourself

Luckily, depositors so far have been spared any direct losses. However, bond and equity holders of these banks have not been as lucky. But how do you, as a bank depositor, take steps to mitigate your risk?

1. Diversify

When it comes to deposits, the FDIC is there to guarantee deposits at US banks of up to $250,000.

The $250,000 limit applies to your total deposits at the bank, so if you have a chequing, savings, and certificate of deposit at one bank, you are insured for a maximum of $250,000 across all three accounts!

Consider keeping an amount that doesn’t exceed the threshold at any one bank. If you exceed that amount, it would be prudent to deposit your money with other financial institutions in order to enjoy the FDIC guarantee. FDIC offers an Electronic Deposit Insurance Estimator (EDIE) so you can check how much coverage you have across all your various banks and holdings.

Most of the over 4,600 banks in the US are FDIC-insured and will prominently display their FDIC coverage. If you are unsure, you can always use the FDIC’s BankFind page to check.

2. Open a joint account

What if you have more than $250,000 at a bank but don’t want to move your money to another bank? You can protect up to $500,000 at a single bank if you open a joint account, say with your spouse.

A married couple could have $1,000,000 in insured deposits if they each have an individual account and a joint account.

3. Know what is covered

FDIC insurance doesn’t cover everything that you keep at your bank. For example, if you have cash in your safety deposit box, that is not covered. If you have stocks and bond investments with your bank, that is also not covered.

However, your IRA (Individual Retirement Account) and self-directed 401k plans are covered.

Refer to FDIC’s website for details on what is covered and what isn’t for you.

If you bank with a credit union, you should check to see if they are insured by the National Credit Union Administration (NCUA), which offers federally insured credit union depositors similar insurance of up to $250,000.

4. Watch out for red flags

There are also certain things that you can look out for. For example, when considering a bank, you might want to:

- Look at its stock price and performance recently;

- Pay attention to the quarterly and annual reports from the bank, as well as investor calls; and

- Watch out for any negative news (using Yahoo or Google Finance) for your bank.

Additional Resources

Is SVB the Next “Lehman Moment”?

See all capital markets resources

Article Sources

- First Republic Bank – About Us

- First Republic Bank – 2021 Annual Report

- Congressional Research Service – Silicon Valley Bank and Signature Bank Failures

- First Republic Bank – Investor Call

- Department of Financial Protection and Innovation – Order Taking Posession

- First Republic Stuck in Standoff Between US, Bank Industry – Bloomberg

- JPMorgan Chase Acquires Substantial Majority of Assets

- JPMorgan Chase Bank, National Association, Columbus, Ohio Assumes All the Deposits of First Republic Bank

- FDIC – Deposit Insurance Fund

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in